Tax Compliance India: Why Honesty Can Feel Like a Burden

Diligently paying taxes in India but feel it’s an uphill battle? Uncover the challenges honest taxpayers face and the push for a fairer system.

Ever found yourself meticulously filling out your ITR forms, a mix of civic duty and a slight feeling of, well, being a bit of a mug? You’re diligently doing your bit for the nation, but then you glance around. You see individuals apparently thriving in an ocean of undeclared wealth, acquiring luxury assets, and seemingly navigating life without a tax care in the world. It makes you pause and wonder, “Am I the one missing a trick by playing it straight?”

This is the perplexing reality many honest taxpayers in India grapple with. It’s a landscape where following the rules can sometimes feel like taking the scenic, and far more expensive, route, while others appear to cruise on a shortcut to prosperity.

The Numbers Game: A Vast Nation, A Smaller Tax Base

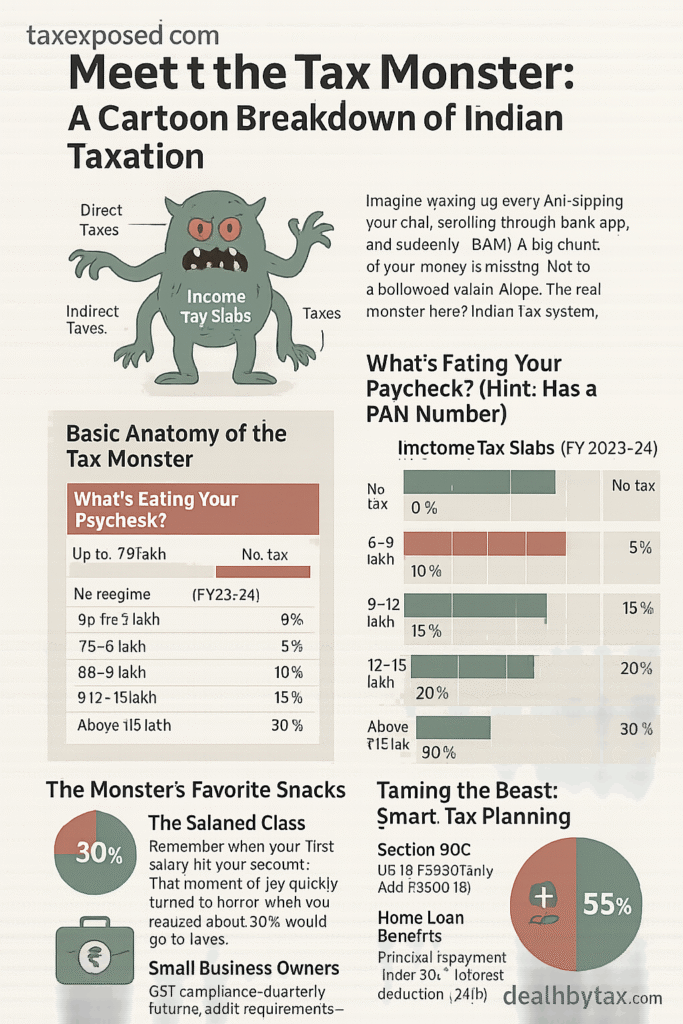

Consider this: in a nation of over 1.4 billion people, data from the Income Tax Department indicates that only around 7 to 8 crore individuals file income tax returns. Delve deeper, and the number of those who actually contribute to the income tax kitty after various deductions and exemptions is even smaller. The implication is stark: a relatively small segment of the population shoulders a significant portion of the direct tax responsibility.

Why this disparity? If you’re a salaried employee or manage a business with transparent dealings, your income is often visible, and taxes, like Tax Deducted at Source (TDS), are applied before you even see the full amount. It’s efficient, but it also means there’s little room for manoeuvre.

Meanwhile, segments of the economy that heavily rely on cash transactions can present a different picture. For instance:

- Certain local businesses might primarily operate in cash, making income tracking more complex.

- Some service providers may prefer non-digital payments, potentially leading to under-declaration.

- Individuals showcasing lavish lifestyles online might not always have commensurate tax filings.

This isn’t to cast aspersions, but to highlight the systemic challenges that can lead to an uneven playing field.

When Honesty Feels Like a Hurdle

Let’s explore how the system can inadvertently make compliance feel more arduous for the diligent.

Salaried Individuals: The Clear Target

For those with a regular salary, TDS ensures tax is collected upfront. There’s no ambiguity, no “adjustments.” Your Form 16 is a testament to your contribution. But this straightforwardness can feel isolating when you observe others operating with less transparency.

GST Complexities: A Challenge for Small Businesses

The Goods and Services Tax (GST) was a landmark reform, but its implementation has its own set of challenges. You might have encountered situations where a seller asks, “Bill chahiye? GST alag se lagega.” Opting out of a formal bill to save that extra amount, while seemingly small, contributes to the informal economy. Businesses that diligently comply with GST, issuing invoices for every transaction and paying their dues, can find themselves at a competitive disadvantage against those who don’t.

The Scrutiny Paradox

Ironically, the more transparent you are with your finances, the more data points you provide for the system to analyse. This can sometimes lead to more queries or notices, even for minor discrepancies or legitimate claims. If you declare all income sources, claim rightful deductions, or have a slight mismatch in your Form 26AS, automated systems might flag your return for a closer look. Those operating largely outside the formal banking and tax system, however, might inadvertently fly under the radar.

Key Insight: The Visibility Factor

The core issue often boils down to visibility. Salaried income and formal business transactions are highly visible to tax authorities. Cash-based transactions and income from the unorganised sector are inherently harder to track, creating an imbalance in compliance pressures.

Navigating the Grey: “Settlement” and Loopholes

There’s also the anecdotal evidence and common perception of “alternative” ways to handle tax disputes if they arise. If undeclared income is discovered, the formal process involves penalties and interest. However, there’s a belief that informal “settlements” or leveraging connections can sometimes lead to more lenient outcomes. Misusing provisions like agricultural income exemptions (which is legitimately tax-exempt for genuine farmers) by showing income from non-existent or exaggerated farm activities is another often-cited loophole used to whiten unaccounted money.

Compare this to the honest taxpayer who makes a small clerical error – they might face the full procedural follow-up, including interest and penalties, potentially for years to come.

The Perceived ROI of Compliance

Let’s look at it purely from a (cynical) cost-benefit perspective, just for argument’s sake. An honest earner pays their income tax, contributes to GST on consumption, and various other cesses. What’s the tangible, direct reward? Often, it’s the satisfaction of being a law-abiding citizen, but beyond that, perks are limited. Public services, funded by these taxes, are for everyone, regardless of their individual tax contribution.

Contrast this with someone who manages to significantly under-report their income. They might pay minimal tax yet enjoy similar, if not better, access to public goods and a higher disposable income to fund a comfortable lifestyle. This apparent disparity can be disheartening for the compliant.

Can the System Become Fairer?

This isn’t about advocating for non-compliance. It’s about asking for a system that doesn’t make the honest feel like they’re at a disadvantage. What’s needed isn’t just tax sops, but fundamental fairness and efficiency.

Potential areas for improvement include:

- Widening the Tax Net: Finding effective, non-intrusive ways to bring more of the cash-intensive sectors into the formal tax system. This broadens the base and reduces the burden on the existing taxpayers.

- Incentivising Compliance: Beyond a clean conscience, what if honest, consistent taxpayers received tangible benefits? Perhaps preferential access to certain schemes, easier credit, or simplified interactions with tax authorities.

- Simplifying Tax Laws: If the average person needs extensive professional help for basic filings, the system is ripe for confusion and evasion. Simpler laws mean easier compliance and fewer loopholes.

- Making Non-Compliance Riskier: Leveraging technology like AI to track large expenditures, property acquisitions, and matching them with declared income can act as a deterrent. Many countries do this effectively.

- Changing the Narrative: Tax authorities could focus on taxpayer facilitation and education, ensuring that compliant individuals feel respected and supported, rather than constantly under suspicion.

Frequently Asked Questions

Why does it often seem like compliant taxpayers face more scrutiny?

Compliant taxpayers, especially salaried individuals and GST-registered businesses, have a transparent financial trail. This makes their data readily available for analysis, and automated systems might flag even minor discrepancies. Those operating largely in cash or outside the formal system leave fewer digital footprints, making them harder to track without specific information.

What percentage of India’s population actually files income tax returns?

As of recent data (around 2023-24), roughly 5-7% of India’s population files income tax returns. A smaller percentage of these filers actually end up paying net income tax after deductions and exemptions are accounted for.

Is it true that agricultural income is completely tax-free in India?

Yes, genuine agricultural income is exempt from income tax in India. However, this provision is sometimes misused by individuals who try to pass off non-agricultural income as farm revenue to evade taxes. Declaring legitimate agricultural income is perfectly legal and encouraged.

How can GST non-compliance by some businesses affect honest ones?

Businesses that don’t comply with GST (e.g., by not issuing proper invoices or under-reporting sales) can often offer lower prices because they aren’t accounting for the tax. This puts honest businesses, who charge GST and pay it to the government, at a competitive price disadvantage.

Final Thoughts

This discussion isn’t an endorsement of cutting corners. Instead, it’s a call to acknowledge the frustrations of honest taxpayers and to advocate for systemic reforms. A fair, transparent, and efficient tax system benefits everyone – the government, the economy, and most importantly, the citizens who contribute diligently.

Until then, if you’re one of the conscientious ones, know that your integrity matters. Let’s hope for a future where honesty is not just a moral virtue but also clearly the most rewarding path.

References:

- Income Tax Department Statistics: https://www.incometax.gov.in

- PRS India – Overview of Tax Revenue: https://prsindia.org

Disclaimer: The information provided in this blog post is for general informational purposes only, and does not constitute professional tax advice. Tax laws are complex and subject to change. Readers are advised to consult with a qualified tax professional or chartered accountant for any specific tax-related concerns, planning, or decisions. The views and opinions expressed in this article are those of the author(s) and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company.